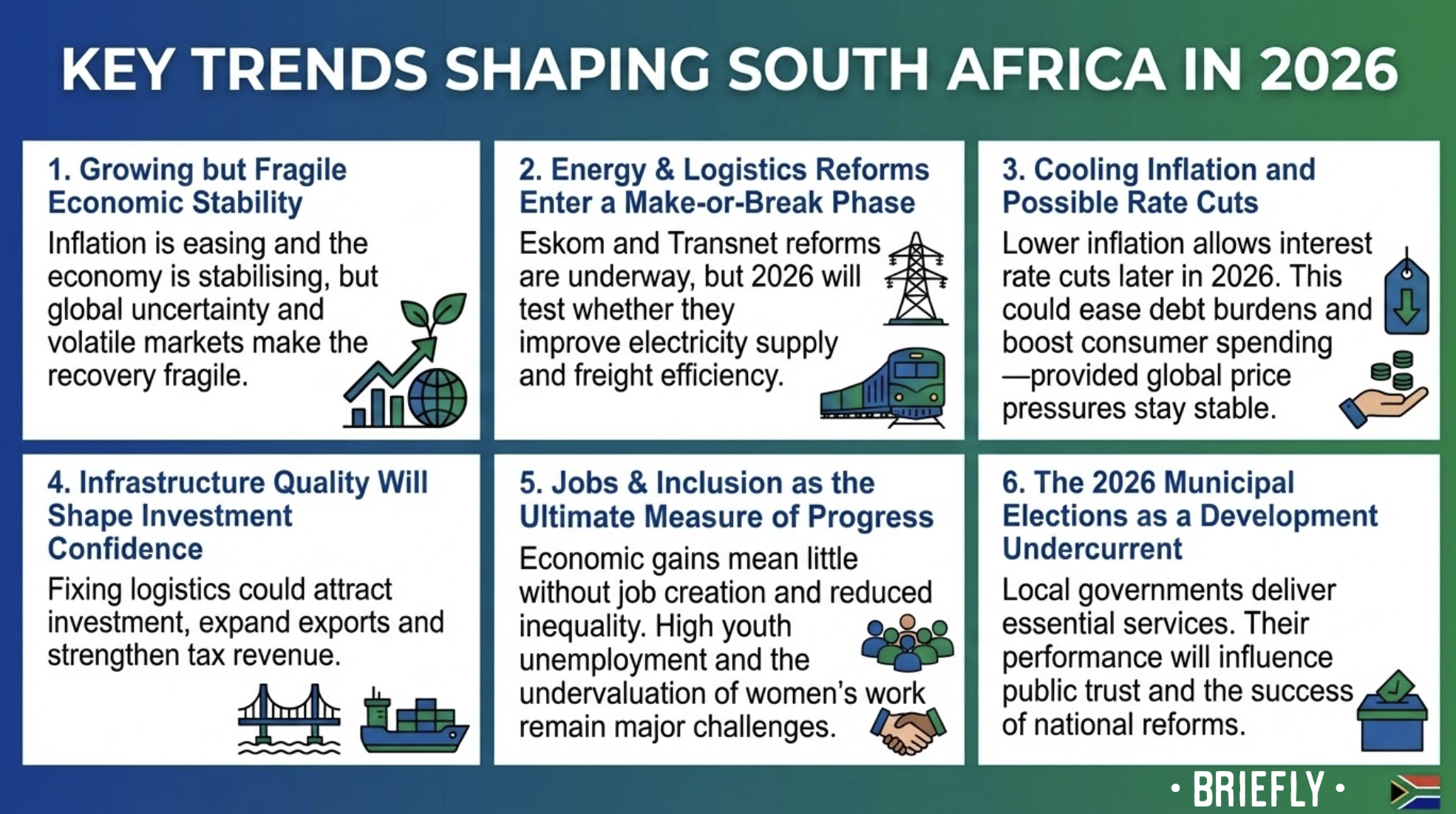

South Africa heads into 2026 with cautious optimism. Inflation is easing, reforms are moving again, and parts of the economy are stabilising.

But global uncertainty, fragile infrastructure, and high unemployment mean the country still faces enormous pressure.

The next 12 months will show whether long-promised reforms finally turn into real progress for ordinary people.

Here are the biggest trends to watch.

Economic stability begins to return, but risks remain high

South Africa enters the year with slightly firmer economic ground. Analysts say inflation is cooling and the economy is shifting into a “low-inflation environment,” according to SARB Governor Lesetja Kganyago.

But stability is fragile. 2026 could still be “turbulent” due to global geopolitical tensions, volatile energy markets, and unstable international demand.

South Africa cannot control these shocks; it can only strengthen what it can control, including fiscal discipline, investment climate and governance.

Whether modest growth turns into meaningful development will depend on whether the gains translate into jobs, confidence and better living conditions.

That remains the real test.

Energy & Logistics Reforms must finally deliver

Energy and logistics reforms are now entering a critical phase.

Eskom’s operational performance has shown periods of stability, and maintenance backlogs are slowly being addressed.

Transnet is expanding private-sector participation in rail and ports, and key terminals are pushing ahead with efficiency plans.

But the question for 2026 is not whether reforms exist, it’s whether they work.

Load shedding and freight failures have held back everything from manufacturing to food supply.

If electricity supply improves and rail corridors stabilise, small businesses can operate consistently, exporters can recover losses, and investors may start to trust the system again.

If these reforms do not deliver tangible improvements this year, South Africa’s development trajectory will remain stuck.

Cooling inflation & expected rate cuts could ease pressure on households

With inflation continuing to cool, interest rate cuts are likely later in 2026. This could be one of the most meaningful boosts for households and small businesses in years.

Lower borrowing costs would allow:

- families to manage debt more easily

- consumers to spend more

- small businesses to invest, hire, and expand

For the first time in a long time, South African households could feel financial relief, but only if global price pressures remain under control.

Any escalation in geopolitical tensions could quickly reverse these gains.

Still, if the trend holds, 2026 may offer the most affordable financial environment since before the pandemic.

Development depends on fixing infrastructure and restoring investor confidence

South Africa’s investment climate hinges on something very simple: whether goods can move efficiently.

Export-heavy sectors, including mining, manufacturing and agriculture, have repeatedly warned that port delays and rail failures are costing them billions. Investors continue to highlight logistics as one of the biggest obstacles to growth.

Unlike the second trend, which focuses on operational reforms, this one speaks to competitiveness.

If ports improve turnaround times and rail corridors become reliable, South Africa becomes a more attractive destination for both local and foreign investment.

Exports grow, tax revenue increases, and jobs become more secure.

If not, the country risks losing global market share, and the development picture weakens.

Jobs & Inclusion Remain the Real Measure of Progress

Even if the economy stabilises, development will ultimately be judged on whether South Africa creates jobs and reduces inequality.

Youth unemployment, stagnant skills development and the slow growth of the township economy remain major barriers.

Women, in particular, carry much of the economic burden.

Many hold families together through domestic work, caregiving, and informal jobs, yet they often remain invisible in policy discussions.

Projects like Briefly News’ Women of Wonder highlight these women and their critical contribution to the country’s social and economic fabric.

If reforms do not translate into real opportunities for women, young people, and low-income households, South Africa cannot claim development progress, no matter what the economic indicators show.

The 2026 Municipal Elections: A Crucial Undercurrent

South Africa’s municipal elections, set for late 2026, add another layer of pressure.

Local government is responsible for water, sanitation, electricity distribution, roads, and housing; the services that shape daily life.

If municipalities fail, national reforms cannot succeed. Voters will therefore expect improved stability, delivery, and accountability at the local level.

These elections may not dominate the economic headlines, but they will directly influence the country’s development path.

2026 could be the year South Africa shifts from talking about reforms to feeling them.

But progress depends on whether energy, logistics, governance, and job creation systems actually deliver for ordinary people.

Development will not be measured by promises but only by whether life becomes more stable, affordable, and inclusive.

*The author of this article, Thembisile Tsambalikagwa, is a Public Relations Specialist and a team member of Briefly News. The views expressed by Thembisile Tsambalikagwa are not necessarily those of The Bulrushes

The post 2026 In South Africa: Trends That Could Shape The Country’s Development appeared first on The Bulrushes.