Merchants and restaurant owners appear to be on record for a sales raise a week after the GST holiday, despite some of the difficulties they encountered when implementing the temporary break. Patrick Hempelmann, the owner of BMV Books, claims that since the tax break started, sales have increased significantly, especially for higher-priced products. He claimed that” the first two days were definitely busier than we otherwise would have been.” For two weeks, a slew of products including children’s toys, snacks, liquor and restaurant foods are GST- or HST-free, depending on the state. Boxing Day in particular, according to Matt Poirier, vice-president of national government relations for the Retail Council of Canada. However, he says firms, including people with older pay networks, have faced barriers trying to implement the tax break on short notice and also figuring out which products qualify. 3: 00

GST trip comes into impact: What shoppers ( and business owners ) need to knowThe complications— and the increase in customers — focus on the shop, he said. For instance, toys outlets reported significant declines in revenue before the tax break was implemented, according to Poirier, as customers waited a few more days to order Christmas gifts. ” For a lot of merchants, it’s shifting the buying habits, but I think overall they’re seeing a gross raise”, he said. Financial saving decreased in November, according to a report from RBC Economics on Thursday, with holiday spending substantially below 2023 levels over the Black Friday weekend. Spending on habits, games and activities scaled up somewhat after Nov. 21, wrote RBC analyst Carrie Freestone — the day the tax crack was announced. ” Generally, spending on popular children’s products builds as the holiday time approaches”, wrote Freestone. But even with November’s decrease, Canada is good on record for a small uptick in per-person wholesale investing in the third quarter for the first time since mid-2022, she wrote. For Hempelmann, the shift has been fairly simple: most of the items in his shop qualify for the income break. ” It wasn’t that complicated”, he said. Trending Then

A 30-year loan with no price excursions: Is the U. S. design work in Canada?

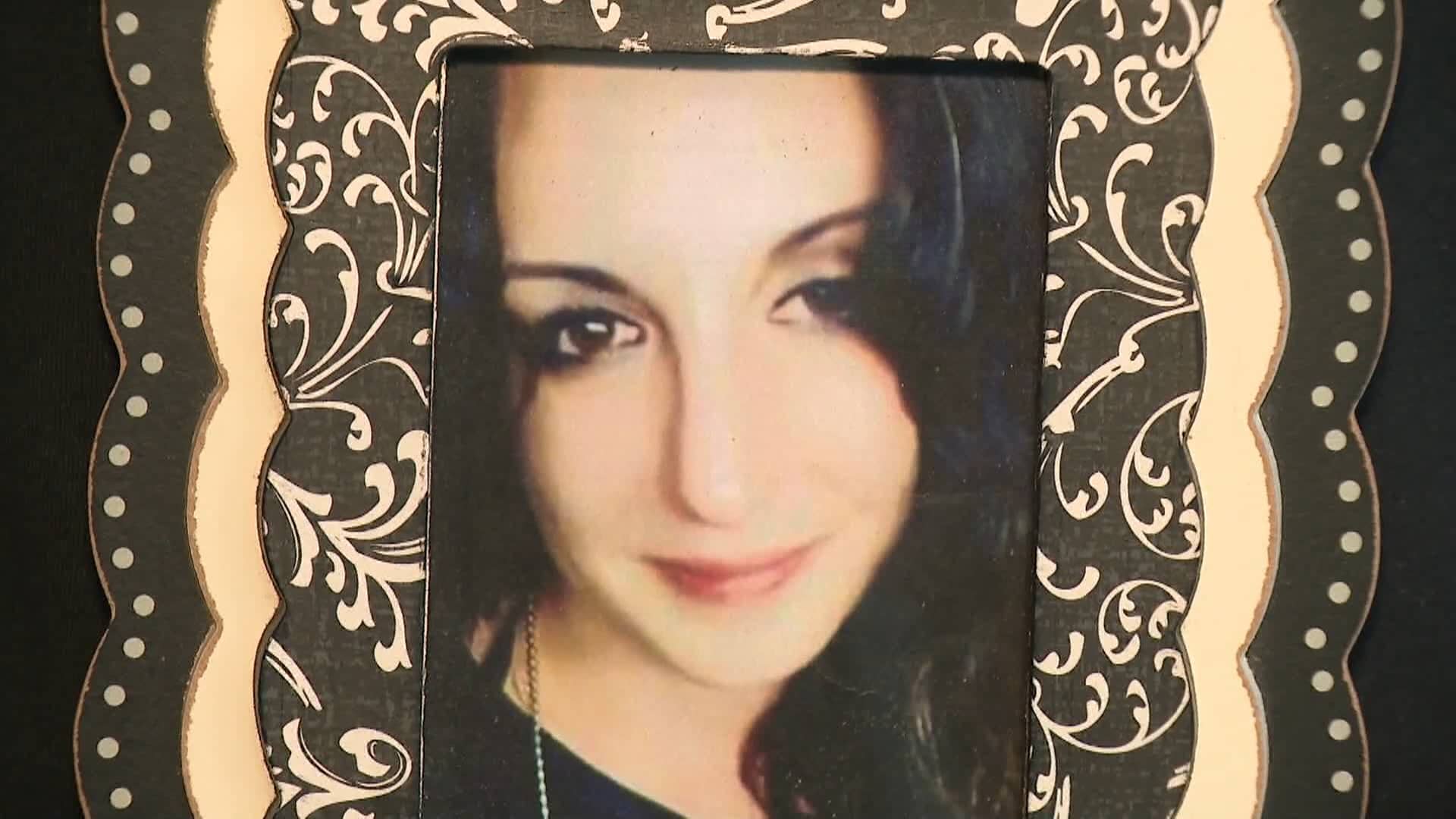

Officer of the Toronto Police ID who had a health emergency died while on work.

2: 08

Hotel industry reacts to national tax’ holiday’However, some items — like pvc records and journals — do not count. Some have caused distress. For instance, Hempelmann said he found out that creative works qualify for the split but the thin, conventional comic ebooks known as “floppy cartoons” do not. Since all they typically sell, excluding hard wine, qualifies for the break, according to Restaurants Canada president and CEO Kelly Higginson. Beer is excluded, as are pre-mixed coffee below seven per share alcohol by volume. Wines, cider and purpose below 22.9 per share are also free. But wine is no. Although the holiday’s revenue increase is delightful, Higginson claims that the anticipated increase in spending during the slow months of January and February will definitely determine the difference. ” I think this is going to really have an impact during that January and February time when people will be able to invest a little bit more,” she said. They will also have some extra money coming out of all the other savings, according to a LCBO director, who added that the alcohol retailer is also seeing an increase in sales as a result of the tax break. &, backup 2024 The Canadian Press