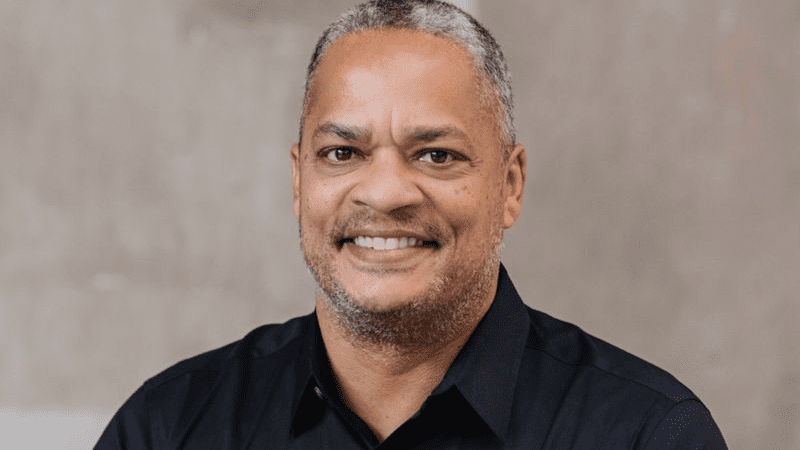

authored by Tony O. Lawson. Footwork, a venture capital firm located in San Francisco, was co-established by Mike Smith and Nikhil Basu Trivedi. The firm is well-regarded for its approach as an operator-first investor. Since its inception in 2021, Footwork has emerged as a vital ally for startups addressing the convergence of technology and practical business issues. The organization has successfully secured two funds: the first, totaling $175 million, was launched in 2021, followed by a second fund of $225 million in 2025. The portfolio features rapidly expanding firms like Table22, Cradlewise, GPTZero, Watershed, and now Confido. Recently, they announced a leadership role in a $15 million Series A funding round for Confido, a platform that provides AI-driven financial automation solutions for consumer-packaged goods (CPG) brands. This investment highlights Footwork’s operator-first strategy in early-stage investing, utilizing extensive operational expertise to assist founders in creating industry-leading companies. Confido, established by Kara Holinski and Justin Hunter, delivers a comprehensive platform that streamlines essential finance and trading processes for CPG brands. Their clientele already features innovative companies such as Olipop and DUDE Wipes. “With my background as COO and CFO, I have witnessed the impact that effective software can have on a company’s profit and loss as well as on team dynamics.” “I’m thrilled to collaborate with Kara Holinski and Justin Hunter at Confido, who are developing an AI-driven financial operating system aimed at supporting outstanding CPG brands as they penetrate retail markets,” stated Mike Smith, co-founder of Footwork, who will also become a member of Confido’s board following this partnership. Additional investors in this funding round include Watchfire Ventures, Y Combinator, BFG Partners, Fintech Fund, Barrel Ventures, and several notable angel investors. Footwork’s growing portfolio and its operator-centric approach are transforming early-stage investment, showcasing the importance of practical guidance and firsthand experience in nurturing the next wave of high-growth startups. Stay updated with similar stories—subscribe to our newsletter for updates on founders, fund managers, and capital business insights. Know any fund managers or founders making significant moves? Send in a business for consideration. Are you looking to invest in Black entrepreneurs and fund managers? Sign up for the Investor List.