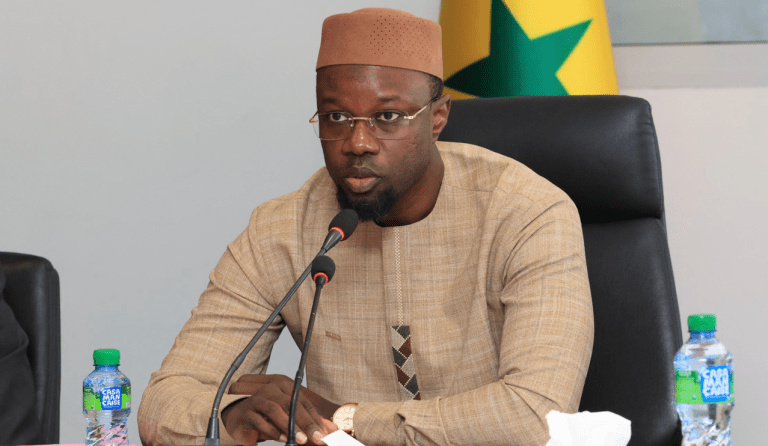

After having been a pioneer in the issuance of sukuk (Islamic bonds), Senegal is about to become the first State of the West African Monetary Union (Umoa) to issue a green bond. The announcement was made on Monday 3 November by the Minister of Finance and Budget, Cheikh Diba, on the occasion of the 2nd edition of the West Africa Sustainable Finance and Investment Forum (Wasfif), held in Dakar. This initiative marks a new stage in the national strategy for diversifying sources of financing and promoting sustainable finance. According to M. In addition, Senegal has already drawn up a framework document to identify projects with a high environmental impact and to build a portfolio of sustainable investments. The objective is to mobilise green resources for the financing of environmentally friendly projects, in coherence with the ESG (Environmental, Social and Governance) principles. ” As for sukuk, we want to be the first to issue a green bond on the regional market. This is part of our strategy for sustainable financing and adaptation to climate change”, said the Minister, stressing the relevance of these mechanisms to support the economic resilience of the African continent. M. and Diba recalled that Africa needs 277 billion dollars a year to adapt to climate change, but receives only about 30 billion.

Green finance: the Senegal traces the path of a new economic era in the UMOA